Backtrader 文档学习-Order Management and Execution

本章提供了关于order的详细功能测试用例,很好很重要。

最后的示例部分,详细分析总结了不同参数的效果和输出。

如果不能模拟订单交易回测就不会完整。为此,平台中提供了以下功能, 对于订单管理3个基本要素:

- buy

- sell

- cancel

对order执行逻辑,有以下类型: - Market

- Close

- Limit

- Stop

- StopLimit

1.Order Management

# buy the main data, with sizer default stake, Market order

# 使用默认data ,默认购买数量,市价订单

order = self.buy()

# Market order - valid will be "IGNORED"

# 有效截止日期到当前时间3天后

order = self.buy(valid=datetime.datetime.now() + datetime.timedelta(days=3))

# Market order - price will be IGNORED

# 成交价格用收盘价的+2%

order = self.buy(price=self.data.close[0] * 1.02)

# Market order - manual stake

# 市价单,25股

order = self.buy(size=25)

# Limit order - want to set the price and can set a validity

# 执行类型,限价执行,+2%的收盘价,当前三天内有效

order = self.buy(exectype=Order.Limit,

price=self.data.close[0] * 1.02,

valid=datetime.datetime.now() + datetime.timedelta(days=3)))

# StopLimit order - want to set the price, price limit

# 限价单模式,+2%成交价收盘价,+7%成交价收盘价,止损(盈)

order = self.buy(exectype=Order.StopLimit,

price=self.data.close[0] * 1.02,

plimit=self.data.close[0] * 1.07)

# Canceling an existing order

# 取消未执行的订单

self.broker.cancel(order)

所有订单类型都可以通过创建订单实例(或其子类之一)来创建,然后通过以下方式传递给代理:

order = self.broker.submit(order)

2.Order Execution Logic

当前数据已经发生,不能用于执行订单。 如果策略中的逻辑是:

if self.data.close > self.sma: # where sma is a Simple Moving Average

self.buy()

策略中用收盘价检查是否触发buy,不能期望订单用策略中正在检查的收盘价执行,因为收盘价已经发生了。

策略条件设置,订单可以在下一组开盘/高/低/收盘价格点(以及订单在此规定的条件)的范围内触发执行 。修改为,用前一天的收盘价做策略,则可以触发buy 。

if self.data.close[-1] > self.sma: # where sma is a Simple Moving Average

self.buy()

- 成交量不起作用

在实际交易中,如果交易者买入非流动性资产,或者恰好触及价格的极限(高/低),就会出现这种情况。(不明白 ??)

但触及高点/低点的情况很少发生(如果你做了……你就不需要BT),所选资产将有足够的流动性来吸收任何常规交易的订单 。(还是不明白 ??)

3.Market

执行:

下一组开盘/高/低/收盘价的开盘价(通常称为bar)

逻辑:

如果逻辑已经在时间点X执行并发布了市价单,将发生的下一个价格点就是即下一个bar的开盘价 。

说明:

该订单始终执行,不考虑用于创建该订单的price和valid 参数

4.Close

执行:

在下一bar平仓时 ,使用下一bar实际收盘价执行。

逻辑:

大多数回测加载数据包含已经收盘bar,订单将立即以下一bar收盘价执行。每日数据加载是最常见的示例。

但是系统可以加载“tick”价格,并且实际bar(时间/日期方面)会随着新tick成交点不断更新,不会实际移动到下一个bar(因为时间和/或日期没有改变,同一天内)。

意思是支持加载类似5分钟线,15分钟线,以tick可以触发买点。

只有当时间或日期改变时,bar才能实际上平仓,订单才会执行 。

5.Limit

-

执行:

如果数据触及订单创建时设置的价格,则下一个价格bar开始执行订单。

如果设置了valid条件,达到有效时间点,订单将被取消 -

价格匹配:

BT尝试为限价单提供最现实的执行价格Limit。

使用4个价格点(开盘/高/低/收盘)可以部分推断出请求的价格是否可以提高。 -

对于买订单:

-

场景1:

如果bar开盘价低于限价订单将立即以开盘价执行。订单将在会话的开始阶段清除。 -

场景 2:

如果开盘价没有跌破限价,但最低价低于限价,则在交易期间达到限价,订单可以执行 。

-

卖单的逻辑显然是颠倒的。

6.Stop

- 执行:

数据触及订单时设置的触发价格,从下一个bar的价格开始。

如果设置了valid并且达到了时间点,订单将被取消 - 价格匹配:

BT尝试为止损单提供最现实的触发价格。

使用4个价格点(开盘/高/低/收盘)可以部分推断出请求的价格是否可以提高。

For Stop orders which Buy

场景 1:

如果bar开盘价高于止损价,订单将立即以开盘价执行。

目的是在价格相对于现有空头头寸向上移动时止损。做空止损

场景 2:

如果开盘价未突破止损价,但最高价高于止损价,则在交易过程中触发止损,订单执行 。

止损订单的逻辑与Sell相反。

7.StopLimit

-

执行:

触发价格从下一个bar价格开始设置订单。 -

价格匹配:

触发:使用- 止损匹配逻辑(但仅触发并将订单转换为限价订单) -

Limit: 使用限价匹配逻辑 。

8.示例

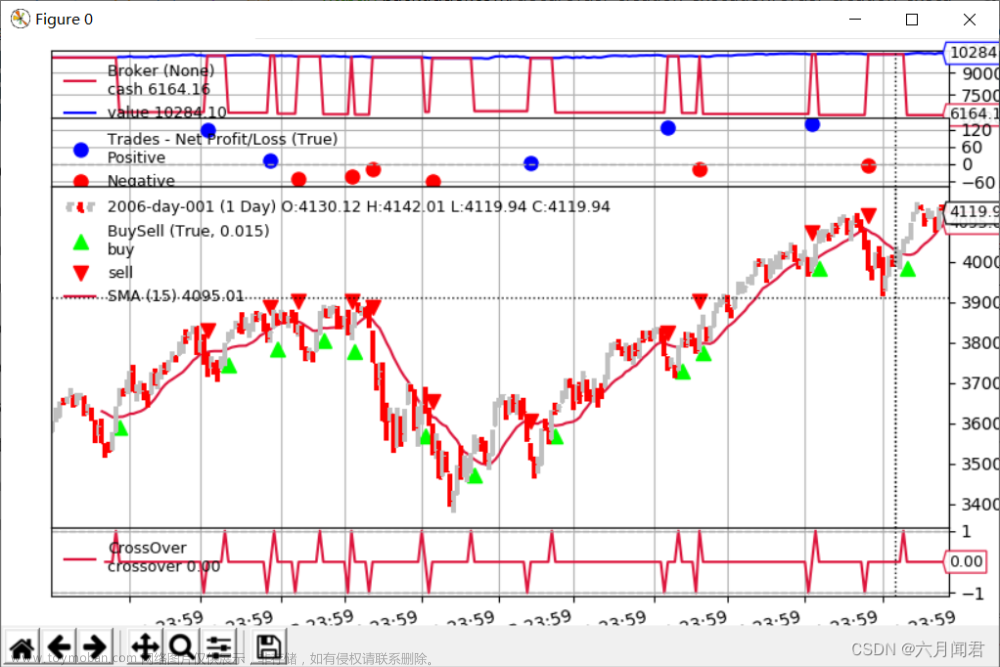

信号出现:使用CrossOver 交叉指标的交叉。

对生成的buy订单调用被保留,在系统中最多只允许一个订单执行。

(1)Execution Type: Market

if self.p.exectype == 'Market':

self.buy(exectype=bt.Order.Market) # default if not given 是默认值

self.log('BUY CREATE, exectype Market, price %.2f' %

self.data.close[0])

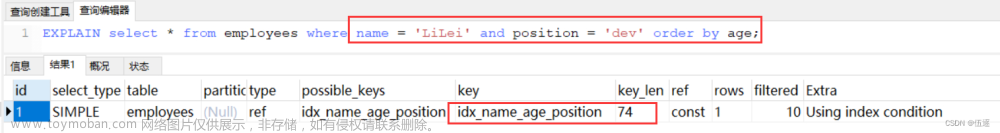

<1>图示

<2>输出

python ./order-execution-samples.py --exectype Market

2006-01-26T23:59:59.999989, BUY CREATE, exectype Market, price 3641.42

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59.999989, BUY EXECUTED, Price: 3643.35, Cost: 3643.35, Comm 0.00

2006-03-02T23:59:59.999989, SELL CREATE, 3763.73

2006-03-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59.999989, SELL EXECUTED, Price: 3763.95, Cost: 3643.35, Comm 0.00

<3>说明

- notify_order() 检查状态:ORDER ACCEPTED/SUBMITTED ,BUY EXPIRED ,BUY EXECUTED ,SELL EXECUTED ,打印输出

- next() 执行买卖操作

- 2006-01-26T23:59:59.999989, BUY CREATE, exectype Market, price 3641.42 ,next触发

- 2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED ,notify_order触发,是两个状态,第一次是提交,第二次是接收,所以有两条记录。

- 2006-01-27T23:59:59.999989, BUY EXECUTED, Price: 3643.35, Cost: 3643.35, Comm 0.00 ,next触发,以27日的open价格成交买入。

- 卖出的效果一下

(2)Execution Type: Close

elif self.p.exectype == 'Close':

self.buy(exectype=bt.Order.Close)

self.log('BUY CREATE, exectype Close, price %.2f' %

self.data.close[0])

<1> 图示

<2> 输出

python ./order-execution-samples.py --exectype Close

2006-01-26T23:59:59.999989, BUY CREATE, exectype Close, price 3641.42

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59.999989, BUY EXECUTED, Price: 3685.48, Cost: 3685.48, Comm 0.00

2006-03-02T23:59:59.999989, SELL CREATE, 3763.73

2006-03-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59.999989, SELL EXECUTED, Price: 3763.95, Cost: 3685.48, Comm 0.00

<3>说明

- 2006-01-27T23:59:59.999989, BUY EXECUTED, Price: 3685.48, Cost: 3685.48, Comm 0.00 ,执行类型是close ,买入的时候以收盘价买入,1月27日的收盘价。

- 2006-03-03T23:59:59.999989, SELL EXECUTED, Price: 3763.95, Cost: 3685.48, Comm 0.00 ,卖出的时候,没有指定类型,sell()都没指定参数,默认是Market ,所以还是以3月3日的开票价卖出。

- bt.Order.Close 执行模式,是要求以收盘价成交!!

- 如果做复杂统一点,可以把sell()也加上相应的参数,与buy一直。

(3)Execution Type: Limit

有效性参数传递设置

if self.p.valid:

valid = self.data.datetime.date(0) + \

datetime.timedelta(days=self.p.valid)

else:

valid = None

设置低于信号生成价格1%的限价(bar的收盘价)。请注意这是如何阻止上面的许多订单被执行的。

elif self.p.exectype == 'Limit':

price = self.data.close * (1.0 - self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Limit, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Limit, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Limit, price %.2f'

self.log(txt % price)

<1> 图示

<2> 输出

python ./order-execution-samples.py --exectype Limit --perc1 1

2006-01-26T23:59:59.999989, BUY CREATE, exectype Limit, price 3605.01

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-05-18T23:59:59.999989, BUY EXECUTED, Price: 3605.01, Cost: 3605.01, Comm 0.00

2006-06-05T23:59:59.999989, SELL CREATE, 3604.33

2006-06-05T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-05T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-06T23:59:59.999989, SELL EXECUTED, Price: 3598.58, Cost: 3605.01, Comm 0.00

2006-06-21T23:59:59.999989, BUY CREATE, exectype Limit, price 3491.57

2006-06-21T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-21T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-28T23:59:59.999989, BUY EXECUTED, Price: 3491.57, Cost: 3491.57, Comm 0.00

2006-07-13T23:59:59.999989, SELL CREATE, 3562.56

2006-07-13T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-07-13T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-07-14T23:59:59.999989, SELL EXECUTED, Price: 3545.92, Cost: 3491.57, Comm 0.00

2006-07-24T23:59:59.999989, BUY CREATE, exectype Limit, price 3596.60

2006-07-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-07-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

<3>说明

- 2006-01-26T23:59:59.999989, BUY CREATE, exectype Limit, price 3605.01,next创建了买单,因为是限价单,用1月26日的收盘价,3641.42 * (100 - 1)/100 = 3605.0058 = 3605.01 。即挂单是低于触发时的收盘价-1% 作为限价。

- 因为没有valid ,所以一直挂单到5月18日

- 2006-05-18T23:59:59.999989, BUY EXECUTED, Price: 3605.01, Cost: 3605.01, Comm 0.00 ,5月18日的价格区间包括3605.01 ,所以能够成交买单,不用OLHC的价格,使用限价价格成交。

2006-5-18 3607.41 3649.54 3558.27 3606.33

- 2006-06-06T23:59:59.999989, SELL EXECUTED, Price: 3598.58, Cost: 3605.01, Comm 0.00 ,卖单触发后,因为没有限价参数,所以都是以开盘价成交。

(4)Execution Type: Limit with validity

为了不永远等待限价单(限价单可能仅在价格与buy订单相反执行),该订单的有效期仅为4天(日历)。

<1>图示

<2>输出

python ./order-execution-samples.py --exectype Limit --perc1 1 --valid 4

2006-01-26T23:59:59.999989, BUY CREATE, exectype Limit, price 3605.01, valid: 2006-01-30

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-30T23:59:59.999989, BUY EXPIRED

2006-03-10T23:59:59.999989, BUY CREATE, exectype Limit, price 3760.48, valid: 2006-03-14

2006-03-10T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-10T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-14T23:59:59.999989, BUY EXPIRED

2006-03-30T23:59:59.999989, BUY CREATE, exectype Limit, price 3835.86, valid: 2006-04-03

2006-03-30T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-30T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-04-03T23:59:59.999989, BUY EXPIRED

2006-04-20T23:59:59.999989, BUY CREATE, exectype Limit, price 3821.40, valid: 2006-04-24

2006-04-20T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-04-20T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-04-24T23:59:59.999989, BUY EXPIRED

2006-05-04T23:59:59.999989, BUY CREATE, exectype Limit, price 3804.65, valid: 2006-05-08

2006-05-04T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-05-04T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-05-08T23:59:59.999989, BUY EXPIRED

2006-06-01T23:59:59.999989, BUY CREATE, exectype Limit, price 3611.85, valid: 2006-06-05

2006-06-01T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-01T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-05T23:59:59.999989, BUY EXPIRED

2006-06-21T23:59:59.999989, BUY CREATE, exectype Limit, price 3491.57, valid: 2006-06-25

2006-06-21T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-21T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-26T23:59:59.999989, BUY EXPIRED

2006-07-24T23:59:59.999989, BUY CREATE, exectype Limit, price 3596.60, valid: 2006-07-28

2006-07-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-07-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-07-28T23:59:59.999989, BUY EXPIRED

2006-09-12T23:59:59.999989, BUY CREATE, exectype Limit, price 3751.07, valid: 2006-09-16

2006-09-12T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-12T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-18T23:59:59.999989, BUY EXPIRED

2006-09-20T23:59:59.999989, BUY CREATE, exectype Limit, price 3802.90, valid: 2006-09-24

2006-09-20T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-20T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-22T23:59:59.999989, BUY EXECUTED, Price: 3802.90, Cost: 3802.90, Comm 0.00

2006-11-02T23:59:59.999989, SELL CREATE, 3974.62

2006-11-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-03T23:59:59.999989, SELL EXECUTED, Price: 3979.73, Cost: 3802.90, Comm 0.00

2006-11-06T23:59:59.999989, BUY CREATE, exectype Limit, price 4004.77, valid: 2006-11-10

2006-11-06T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-06T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-10T23:59:59.999989, BUY EXPIRED

2006-12-11T23:59:59.999989, BUY CREATE, exectype Limit, price 4012.36, valid: 2006-12-15

2006-12-11T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-12-11T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-12-15T23:59:59.999989, BUY EXPIRED

<3>说明

- 2006-01-26, BUY CREATE, exectype Limit, price 3605.01, valid: 2006-01-30 ,触发买单,注意有valid ,限制在4天内有效,当前是26日,有效期到30日。

- 2006-01-30T23:59:59.999989, BUY EXPIRED ,30日,没有能够到达限价内,并且时间限制到达,所以买单过期

- 2006-09-20T23:59:59.999989, BUY CREATE, exectype Limit, price 3802.90, valid: 2006-09-24 ,收盘价:3841.31,限价:3841.31 * 0.99 = 3802.8969 =3802.90 ,9月24日超期。

- 2006-09-22T23:59:59.999989, BUY EXECUTED, Price: 3802.90, Cost: 3802.90, Comm 0.00 ,在9月22日的价格区间内,并且没有超过4天,买单成交。

2006-9-22 3839.51 3839.65 3800.65 3812.73

(5)Execution Type: Stop

设置高于信号价格1%的止损价格。该策略只在信号产生且价格继续攀升时买入,可解读为强势信号。

elif self.p.exectype == 'Stop':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Stop, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Stop, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Stop, price %.2f'

self.log(txt % price)

<1>图示

<2>输出

python ./order-execution-samples.py --exectype Stop --perc1 1

2006-01-26T23:59:59.999989, BUY CREATE, exectype Stop, price 3677.83

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-27T23:59:59.999989, BUY EXECUTED, Price: 3677.83, Cost: 3677.83, Comm 0.00

2006-03-02T23:59:59.999989, SELL CREATE, 3763.73

2006-03-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59.999989, SELL EXECUTED, Price: 3763.95, Cost: 3677.83, Comm 0.00

2006-03-10T23:59:59.999989, BUY CREATE, exectype Stop, price 3836.44

2006-03-10T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-10T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-15T23:59:59.999989, BUY EXECUTED, Price: 3836.44, Cost: 3836.44, Comm 0.00

2006-03-28T23:59:59.999989, SELL CREATE, 3811.45

2006-03-28T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-28T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-29T23:59:59.999989, SELL EXECUTED, Price: 3811.85, Cost: 3836.44, Comm 0.00

2006-03-30T23:59:59.999989, BUY CREATE, exectype Stop, price 3913.36

2006-03-30T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-30T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-29T23:59:59.999989, BUY EXECUTED, Price: 3913.36, Cost: 3913.36, Comm 0.00

2006-11-02T23:59:59.999989, SELL CREATE, 3974.62

2006-11-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-03T23:59:59.999989, SELL EXECUTED, Price: 3979.73, Cost: 3913.36, Comm 0.00

2006-11-06T23:59:59.999989, BUY CREATE, exectype Stop, price 4085.67

2006-11-06T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-06T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-13T23:59:59.999989, BUY EXECUTED, Price: 4085.67, Cost: 4085.67, Comm 0.00

2006-11-24T23:59:59.999989, SELL CREATE, 4048.16

2006-11-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-27T23:59:59.999989, SELL EXECUTED, Price: 4045.05, Cost: 4085.67, Comm 0.00

2006-12-11T23:59:59.999989, BUY CREATE, exectype Stop, price 4093.42

2006-12-11T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-12-11T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-12-13T23:59:59.999989, BUY EXECUTED, Price: 4093.42, Cost: 4093.42, Comm 0.00

<3>说明

- 2006-01-26T23:59:59.999989, BUY CREATE, exectype Stop, price 3677.83 ,收盘价:3641.42 , 限价:3641.42 *1.01 = 3677.8342 = 3677.83

2006-1-26 3578.92 3641.42 3577.98 3641.42

- 2006-01-27T23:59:59.999989, BUY EXECUTED, Price: 3677.83, Cost: 3677.83, Comm 0.00 ,限价包括在27日的价格中,成交。

2006-1-27 3643.35 3685.48 3643.35 3685.48

- 从Limit 和 Stop 对比,区别在于设置限价,Limit是降低1个百分点,stop 是升高1个百分点。把Stop的增加1个百分点,修改为降低1个百分点,也可以执行。对比理解:

Limit降低1个百分点的结果:

python ./order-execution-samples.py --exectype Limit --perc1 1

2006-01-26, BUY CREATE, exectype Limit, price 3605.01

2006-01-26, ORDER ACCEPTED/SUBMITTED

2006-01-26, ORDER ACCEPTED/SUBMITTED

2006-05-18, BUY EXECUTED, Price: 3605.01, Cost: 3605.01, Comm 0.00

Stop降低1个百分点的结果:

python ./order-execution-samples.py --exectype Stop --perc1 1

2006-01-26, BUY CREATE, exectype Stop, price 3605.01

2006-01-26, ORDER ACCEPTED/SUBMITTED

2006-01-26, ORDER ACCEPTED/SUBMITTED

2006-01-27, BUY EXECUTED, Price: 3643.35, Cost: 3643.35, Comm 0.00

Limit 和Stop 的区别:

- Limit 执行的价格,要市价达到 3605.01 价格,才能成交,以限价价格成交。

- Stop 执行的价格,只要市价大于 3605.01 价格,就可以成交,以市价的开盘价成交。所以有止损的功能!

(6)Execution Type: StopLimit

设置高于信号价格1%的止损价格。但是限价设置在信号(收盘)价以上0.5%,解释为等待力量出现,但不要购买峰值,等待下落。

有效期上限为20天(日历)。

elif self.p.exectype == 'StopLimit':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

plimit = self.data.close * (1.0 + self.p.perc2 / 100.0)

self.buy(exectype=bt.Order.StopLimit, price=price, valid=valid,

plimit=plimit)

if self.p.valid:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' valid: %s, pricelimit: %.2f')

self.log(txt % (price, valid.strftime('%Y-%m-%d'), plimit))

else:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' pricelimit: %.2f')

self.log(txt % (price, plimit))

<1>图示

<2>输出

python ./order-execution-samples.py --exectype StopLimit --perc1 1 --perc2 0.5 --valid 20

2006-01-26T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3677.83, valid: 2006-02-15, pricelimit: 3659.63

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-01-26T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-02-03T23:59:59.999989, BUY EXECUTED, Price: 3659.63, Cost: 3659.63, Comm 0.00

2006-03-02T23:59:59.999989, SELL CREATE, 3763.73

2006-03-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-03T23:59:59.999989, SELL EXECUTED, Price: 3763.95, Cost: 3659.63, Comm 0.00

2006-03-10T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3836.44, valid: 2006-03-30, pricelimit: 3817.45

2006-03-10T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-10T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-21T23:59:59.999989, BUY EXECUTED, Price: 3817.45, Cost: 3817.45, Comm 0.00

2006-03-28T23:59:59.999989, SELL CREATE, 3811.45

2006-03-28T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-28T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-29T23:59:59.999989, SELL EXECUTED, Price: 3811.85, Cost: 3817.45, Comm 0.00

2006-03-30T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3913.36, valid: 2006-04-19, pricelimit: 3893.98

2006-03-30T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-03-30T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-04-19T23:59:59.999989, BUY EXPIRED

2006-04-20T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3898.60, valid: 2006-05-10, pricelimit: 3879.30

2006-04-20T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-04-20T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-05-10T23:59:59.999989, BUY EXPIRED

2006-06-01T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3684.81, valid: 2006-06-21, pricelimit: 3666.57

2006-06-01T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-01T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-02T23:59:59.999989, BUY EXECUTED, Price: 3666.57, Cost: 3666.57, Comm 0.00

2006-06-05T23:59:59.999989, SELL CREATE, 3604.33

2006-06-05T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-05T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-06T23:59:59.999989, SELL EXECUTED, Price: 3598.58, Cost: 3666.57, Comm 0.00

2006-06-21T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3562.11, valid: 2006-07-11, pricelimit: 3544.47

2006-06-21T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-21T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-06-23T23:59:59.999989, BUY EXECUTED, Price: 3544.47, Cost: 3544.47, Comm 0.00

2006-07-13T23:59:59.999989, SELL CREATE, 3562.56

2006-07-13T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-07-13T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-07-14T23:59:59.999989, SELL EXECUTED, Price: 3545.92, Cost: 3544.47, Comm 0.00

2006-07-24T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3669.26, valid: 2006-08-13, pricelimit: 3651.09

2006-07-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-07-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-08-01T23:59:59.999989, BUY EXECUTED, Price: 3651.09, Cost: 3651.09, Comm 0.00

2006-09-06T23:59:59.999989, SELL CREATE, 3772.21

2006-09-06T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-06T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-07T23:59:59.999989, SELL EXECUTED, Price: 3766.80, Cost: 3651.09, Comm 0.00

2006-09-12T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3826.85, valid: 2006-10-02, pricelimit: 3807.90

2006-09-12T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-12T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-09-22T23:59:59.999989, BUY EXECUTED, Price: 3807.90, Cost: 3807.90, Comm 0.00

2006-11-02T23:59:59.999989, SELL CREATE, 3974.62

2006-11-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-02T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-03T23:59:59.999989, SELL EXECUTED, Price: 3979.73, Cost: 3807.90, Comm 0.00

2006-11-06T23:59:59.999989, BUY CREATE, exectype StopLimit, price 4085.67, valid: 2006-11-26, pricelimit: 4065.45

2006-11-06T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-06T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-20T23:59:59.999989, BUY EXECUTED, Price: 4065.45, Cost: 4065.45, Comm 0.00

2006-11-24T23:59:59.999989, SELL CREATE, 4048.16

2006-11-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-24T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-11-27T23:59:59.999989, SELL EXECUTED, Price: 4045.05, Cost: 4065.45, Comm 0.00

2006-12-11T23:59:59.999989, BUY CREATE, exectype StopLimit, price 4093.42, valid: 2006-12-31, pricelimit: 4073.15

2006-12-11T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-12-11T23:59:59.999989, ORDER ACCEPTED/SUBMITTED

2006-12-22T23:59:59.999989, BUY EXECUTED, Price: 4073.15, Cost: 4073.15, Comm 0.00

<3>说明

- 2006-01-26T23:59:59.999989, BUY CREATE, exectype StopLimit, price 3677.83, valid: 2006-02-15, pricelimit: 3659.63

2006-1-26 3578.92 3641.42 3577.98 3641.42

用收盘价计算:

3641.42 * 1.01 = 3677.8342 = 3677.83

3641.42 * 1.005 = 3659.6271 = 3659.63

数据一致:

price: 3677.83

pricelimit: 3659.63

- 2006-02-03T23:59:59.999989, BUY EXECUTED, Price: 3659.63, Cost: 3659.63, Comm 0.00

2006-2-3 3677.05 3696 3652.76 3678.48

不是以限价3677.83成交,而是以止损限价3659.63成交。

再理解一下:

设置高于信号价格1%的止损价格。但是限价设置在信号(收盘)价以上0.5%,解释为等待力量出现,但不要购买峰值,等待下落。文章来源:https://www.toymoban.com/news/detail-820776.html

(7)Test Script Execution Help

python ./order-execution-samples.py --help

usage: order-execution-samples.py [-h] [--infile INFILE]

[--csvformat {bt,visualchart,sierrachart,yahoo,yahoo_unreversed}]

[--fromdate FROMDATE] [--todate TODATE]

[--plot] [--plotstyle {bar,line,candle}]

[--numfigs NUMFIGS] [--smaperiod SMAPERIOD]

[--exectype EXECTYPE] [--valid VALID]

[--perc1 PERC1] [--perc2 PERC2]

Showcase for Order Execution Types

optional arguments:

-h, --help show this help message and exit

--infile INFILE, -i INFILE

File to be read in

--csvformat {bt,visualchart,sierrachart,yahoo,yahoo_unreversed}, -c {bt,visualchart,sierrachart,yahoo,yahoo_unreversed}

CSV Format

--fromdate FROMDATE, -f FROMDATE

Starting date in YYYY-MM-DD format

--todate TODATE, -t TODATE

Ending date in YYYY-MM-DD format

--plot, -p Plot the read data

--plotstyle {bar,line,candle}, -ps {bar,line,candle}

Plot the read data

--numfigs NUMFIGS, -n NUMFIGS

Plot using n figures

--smaperiod SMAPERIOD, -s SMAPERIOD

Simple Moving Average Period

--exectype EXECTYPE, -e EXECTYPE

Execution Type: Market (default), Close, Limit, Stop,

StopLimit

--valid VALID, -v VALID

Validity for Limit sample: default 0 days

--perc1 PERC1, -p1 PERC1

% distance from close price at order creation time for

the limit/trigger price in Limit/Stop orders

--perc2 PERC2, -p2 PERC2

% distance from close price at order creation time for

the limit price in StopLimit orders

(8)源码

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import argparse

import datetime

import os.path

import time

import sys

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

class OrderExecutionStrategy(bt.Strategy):

params = (

('smaperiod', 15),

('exectype', 'Market'),

('perc1', 3),

('perc2', 1),

('valid', 4),

)

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.data.datetime[0]

if isinstance(dt, float):

dt = bt.num2date(dt)

print('%s, %s' % (dt.isoformat(), txt))

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

self.log('ORDER ACCEPTED/SUBMITTED', dt=order.created.dt)

self.order = order

return

if order.status in [order.Expired]:

self.log('BUY EXPIRED')

elif order.status in [order.Completed]:

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

else: # Sell

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

# Sentinel to None: new orders allowed

self.order = None

def __init__(self):

# SimpleMovingAverage on main data

# Equivalent to -> sma = btind.SMA(self.data, period=self.p.smaperiod)

sma = btind.SMA(period=self.p.smaperiod)

# CrossOver (1: up, -1: down) close / sma

self.buysell = btind.CrossOver(self.data.close, sma, plot=True)

# Sentinel to None: new ordersa allowed

self.order = None

def next(self):

if self.order:

# An order is pending ... nothing can be done

return

# Check if we are in the market

if self.position:

# In the maerket - check if it's the time to sell

if self.buysell < 0:

self.log('SELL CREATE, %.2f' % self.data.close[0])

self.sell()

elif self.buysell > 0:

if self.p.valid:

valid = self.data.datetime.date(0) + \

datetime.timedelta(days=self.p.valid)

else:

valid = None

# Not in the market and signal to buy

if self.p.exectype == 'Market':

self.buy(exectype=bt.Order.Market) # default if not given

self.log('BUY CREATE, exectype Market, price %.2f' %

self.data.close[0])

elif self.p.exectype == 'Close':

self.buy(exectype=bt.Order.Close)

self.log('BUY CREATE, exectype Close, price %.2f' %

self.data.close[0])

elif self.p.exectype == 'Limit':

price = self.data.close * (1.0 - self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Limit, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Limit, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Limit, price %.2f'

self.log(txt % price)

elif self.p.exectype == 'Stop':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

self.buy(exectype=bt.Order.Stop, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Stop, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Stop, price %.2f'

self.log(txt % price)

elif self.p.exectype == 'StopLimit':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

plimit = self.data.close * (1.0 + self.p.perc2 / 100.0)

self.buy(exectype=bt.Order.StopLimit, price=price, valid=valid,

plimit=plimit)

if self.p.valid:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' valid: %s, pricelimit: %.2f')

self.log(txt % (price, valid.strftime('%Y-%m-%d'), plimit))

else:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' pricelimit: %.2f')

self.log(txt % (price, plimit))

def runstrat():

args = parse_args()

cerebro = bt.Cerebro()

data = getdata(args)

cerebro.adddata(data)

cerebro.addstrategy(

OrderExecutionStrategy,

exectype=args.exectype,

perc1=args.perc1,

perc2=args.perc2,

valid=args.valid,

smaperiod=args.smaperiod

)

cerebro.run()

if args.plot:

cerebro.plot(numfigs=args.numfigs, style=args.plotstyle)

def getdata(args):

dataformat = dict(

bt=btfeeds.BacktraderCSVData,

visualchart=btfeeds.VChartCSVData,

sierrachart=btfeeds.SierraChartCSVData,

yahoo=btfeeds.YahooFinanceCSVData,

yahoo_unreversed=btfeeds.YahooFinanceCSVData

)

dfkwargs = dict()

if args.csvformat == 'yahoo_unreversed':

dfkwargs['reverse'] = True

if args.fromdate:

fromdate = datetime.datetime.strptime(args.fromdate, '%Y-%m-%d')

dfkwargs['fromdate'] = fromdate

if args.todate:

fromdate = datetime.datetime.strptime(args.todate, '%Y-%m-%d')

dfkwargs['todate'] = todate

dfkwargs['dataname'] = args.infile

dfcls = dataformat[args.csvformat]

return dfcls(**dfkwargs)

def parse_args():

parser = argparse.ArgumentParser(

description='Showcase for Order Execution Types')

parser.add_argument('--infile', '-i', required=False,

default='./datas/2006-day-001.txt',

help='File to be read in')

parser.add_argument('--csvformat', '-c', required=False, default='bt',

choices=['bt', 'visualchart', 'sierrachart',

'yahoo', 'yahoo_unreversed'],

help='CSV Format')

parser.add_argument('--fromdate', '-f', required=False, default=None,

help='Starting date in YYYY-MM-DD format')

parser.add_argument('--todate', '-t', required=False, default=None,

help='Ending date in YYYY-MM-DD format')

parser.add_argument('--plot', '-p', action='store_false', required=False,

help='Plot the read data')

parser.add_argument('--plotstyle', '-ps', required=False, default='bar',

choices=['bar', 'line', 'candle'],

help='Plot the read data')

parser.add_argument('--numfigs', '-n', required=False, default=1,

help='Plot using n figures')

parser.add_argument('--smaperiod', '-s', required=False, default=15,

help='Simple Moving Average Period')

parser.add_argument('--exectype', '-e', required=False, default='Market',

help=('Execution Type: Market (default), Close, Limit,'

' Stop, StopLimit'))

parser.add_argument('--valid', '-v', required=False, default=0, type=int,

help='Validity for Limit sample: default 0 days')

parser.add_argument('--perc1', '-p1', required=False, default=0.0,

type=float,

help=('%% distance from close price at order creation'

' time for the limit/trigger price in Limit/Stop'

' orders'))

parser.add_argument('--perc2', '-p2', required=False, default=0.0,

type=float,

help=('%% distance from close price at order creation'

' time for the limit price in StopLimit orders'))

return parser.parse_args()

if __name__ == '__main__':

runstrat()

(9)修改为ipython版本

把所有输入参数都内置到程序中,通过调整参数,实现命令行方式的参数测试。文章来源地址https://www.toymoban.com/news/detail-820776.html

from __future__ import (absolute_import, division, print_function,

unicode_literals)

#import argparse

import datetime

import os.path

import time

import sys

import backtrader as bt

import backtrader.feeds as btfeeds

import backtrader.indicators as btind

%matplotlib inline

class OrderExecutionStrategy(bt.Strategy):

params = (

('smaperiod', 15),

('exectype', 'Market'),

('perc1', 3),

('perc2', 1),

('valid', 4),

)

def log(self, txt, dt=None):

''' Logging function fot this strategy'''

dt = dt or self.data.datetime[0]

if isinstance(dt, float):

dt = bt.num2date(dt)

print('%s, %s' % (dt.isoformat()[:10], txt)) # 字符串,仅显示日期,不显示时分秒

def notify_order(self, order):

# 订单提交、接收状态处理

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

self.log('ORDER ACCEPTED/SUBMITTED', dt=order.created.dt)

self.order = order

return

#订单过期处理

if order.status in [order.Expired]:

self.log('BUY EXPIRED')

#订单完成处理

elif order.status in [order.Completed]:

#买单操作

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

#卖单操作

else: # Sell

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

# Sentinel to None: new orders allowed

self.order = None

def __init__(self):

# SimpleMovingAverage on main data

# Equivalent to -> sma = btind.SMA(self.data, period=self.p.smaperiod)

# SMA赋值,用params参数中的周期 15 天

sma = btind.SMA(period=self.p.smaperiod)

# CrossOver (1: up, -1: down) close / sma

# 买卖标志,收盘上穿SMA 1 ,收盘下穿SMA -1

self.buysell = btind.CrossOver(self.data.close, sma, plot=True)

# Sentinel to None: new orders allowed

self.order = None

def next(self):

# 如有订单,无操作,返回

if self.order:

# An order is pending ... nothing can be done

return

# Check if we are in the market

# 如无订单,检查仓位

if self.position:

# In the maerket - check if it's the time to sell

# 小于0 ,卖出

if self.buysell < 0:

self.log('SELL CREATE, %.2f' % self.data.close[0])

self.sell()

# 大于0 ,买入

elif self.buysell > 0:

# 买入时,(1)先检查param的参数valid ,使用valid参数,设置订单有效期限

if self.p.valid:

valid = self.data.datetime.date(0) + \

datetime.timedelta(days=self.p.valid)

else:

valid = None

# Not in the market and signal to buy

# 买入时,(2)检查执行类型 ,默认是 Market

if self.p.exectype == 'Market':

self.buy(exectype=bt.Order.Market) # default if not given

self.log('BUY CREATE, exectype Market, price %.2f' %

self.data.close[0])

# 买入时,执行类型,Close

elif self.p.exectype == 'Close':

self.buy(exectype=bt.Order.Close)

self.log('BUY CREATE, exectype Close, price %.2f' %

self.data.close[0])

# 买入时,执行类型,限价Limit

elif self.p.exectype == 'Limit':

price = self.data.close * (1.0 - self.p.perc1 / 100.0)

# 执行买入操作,限价,执行参数: price valid

self.buy(exectype=bt.Order.Limit, price=price, valid=valid)

# valid ??

if self.p.valid:

txt = 'BUY CREATE, exectype Limit, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Limit, price %.2f'

self.log(txt % price)

# 买入时,执行类型,止损止盈 Stop

elif self.p.exectype == 'Stop':

# 执行价格:收盘价的 +3%

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

# 执行买入操作, Stop操作

self.buy(exectype=bt.Order.Stop, price=price, valid=valid)

if self.p.valid:

txt = 'BUY CREATE, exectype Stop, price %.2f, valid: %s'

self.log(txt % (price, valid.strftime('%Y-%m-%d')))

else:

txt = 'BUY CREATE, exectype Stop, price %.2f'

self.log(txt % price)

# 设置高于信号价格3%的止损止盈价格,限价设置在信号(收盘)价以上1%

elif self.p.exectype == 'StopLimit':

price = self.data.close * (1.0 + self.p.perc1 / 100.0)

plimit = self.data.close * (1.0 + self.p.perc2 / 100.0)

self.buy(exectype=bt.Order.StopLimit, price=price, valid=valid,

plimit=plimit)

if self.p.valid:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' valid: %s, pricelimit: %.2f')

self.log(txt % (price, valid.strftime('%Y-%m-%d'), plimit))

else:

txt = ('BUY CREATE, exectype StopLimit, price %.2f,'

' pricelimit: %.2f')

self.log(txt % (price, plimit))

'''

--exectype Market

--exectype Close

--exectype Limit --perc1 1

--exectype Limit --perc1 1 --valid 4

--exectype Stop --perc1 1

--exectype StopLimit --perc1 1 --perc2 0.5 --valid 20

'''

def runstrat():

param_exectype = ['Market', 'Close', 'Limit','Stop', 'StopLimit']

param_plotstyle=['bar', 'line', 'candle']

param_numfigs = 1 # no use

param_perc1 = 0

param_perc2 = 0

param_valid = 0

param_smaperiod = 15

param_plot = False

cerebro = bt.Cerebro()

data = getdata()

#print(data)

cerebro.adddata(data)

#print('add data finished!')

cerebro.addstrategy(

OrderExecutionStrategy,

exectype=param_exectype[3],

perc1=param_perc1,

perc2=param_perc2,

valid=param_valid,

smaperiod=param_smaperiod

)

#print('add strategy finished!')

cerebro.run()

if param_plot:

cerebro.plot(iplot=False, style=param_plotstyle[0])

def getdata():

dataformat = dict(

bt=btfeeds.BacktraderCSVData,

visualchart=btfeeds.VChartCSVData,

sierrachart=btfeeds.SierraChartCSVData,

yahoo=btfeeds.YahooFinanceCSVData,

yahoo_unreversed=btfeeds.YahooFinanceCSVData

)

choices=['bt', 'visualchart', 'sierrachart','yahoo', 'yahoo_unreversed']

param_infile = './datas/2006-day-001.txt'

param_csvformat = choices[0] # default : bt

param_fromdate = None

param_todate = None

dfkwargs = dict()

if param_csvformat == 'yahoo_unreversed':

dfkwargs['reverse'] = True

if param_fromdate:

fromdate = datetime.datetime.strptime(param_fromdate, '%Y-%m-%d')

dfkwargs['fromdate'] = fromdate

if param_todate:

tomdate = datetime.datetime.strptime(param_todate, '%Y-%m-%d')

dfkwargs['todate'] = todate

dfkwargs['dataname'] = param_infile

dfcls = dataformat[param_csvformat]

#print (dfkwargs)

return dfcls(**dfkwargs)

if __name__ == '__main__':

runstrat()

到了这里,关于Backtrader 文档学习-Order Management and Execution的文章就介绍完了。如果您还想了解更多内容,请在右上角搜索TOY模板网以前的文章或继续浏览下面的相关文章,希望大家以后多多支持TOY模板网!